Use Your HSA or FSA for Better Sleep

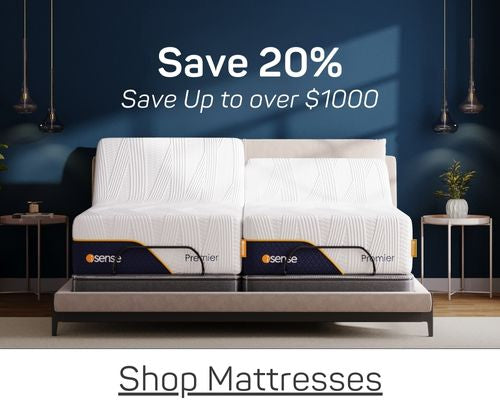

Save up to 30% on your iSense Smart Bed using pre-tax dollars.*

We’re proud to partner with TrueMed to make it easier, and more affordable, to invest in better sleep. If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), you may be eligible to use those pre-tax dollars toward the purchase of an iSense Smart Bed. That can translate to average savings of 30%.*

How it Works

Step 1:

Add to cart

Choose your iSense Smart Bed and proceed to checkout.

Step 2:

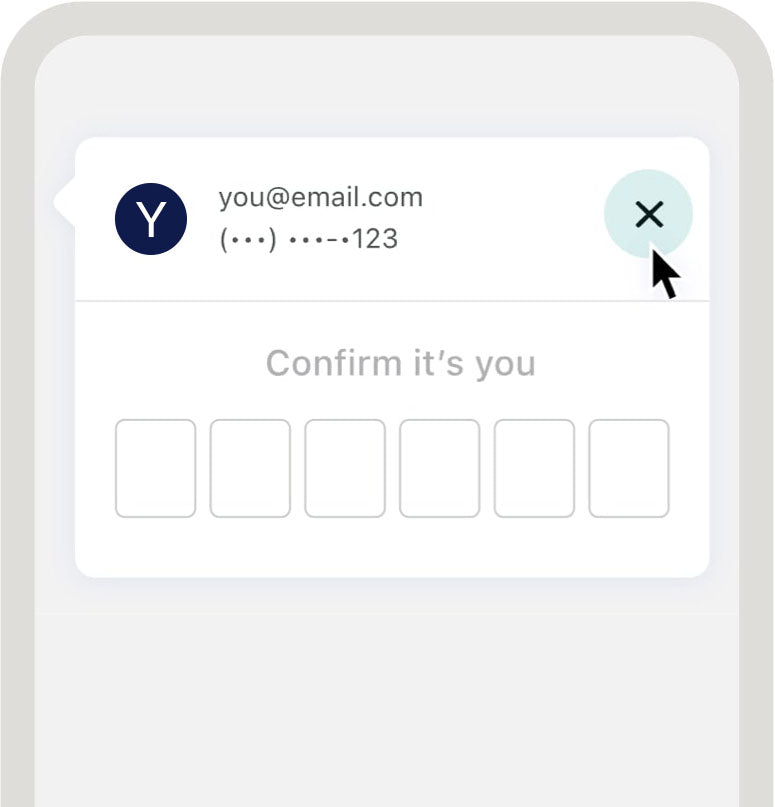

Check out as a guest

Do not log into Shop Pay or use any accelerated checkout options. If a verification pop-up appears, simply close it.

Step 3:

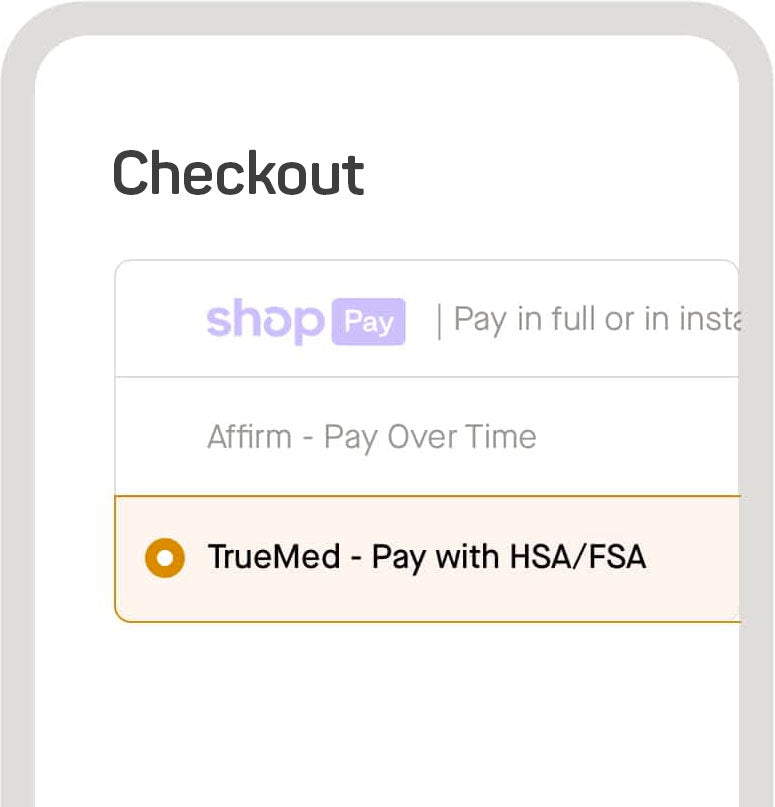

Choose HSA/FSA

at checkout

Select TrueMed as your payment method.

Step 4:

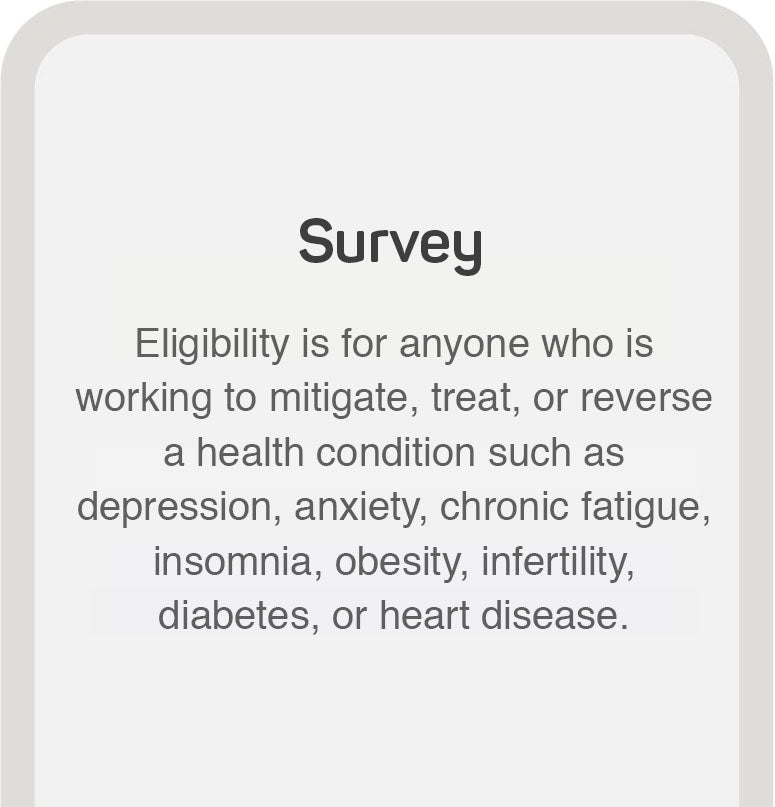

Complete the quick

survey

Answer a few health-related questions to determine eligibility and receive a Letter of Medical Necessity.

Why This Matters

For qualified customers, this is a smart, compliant way to invest in lasting

comfort and support, without compromise.

FAQ

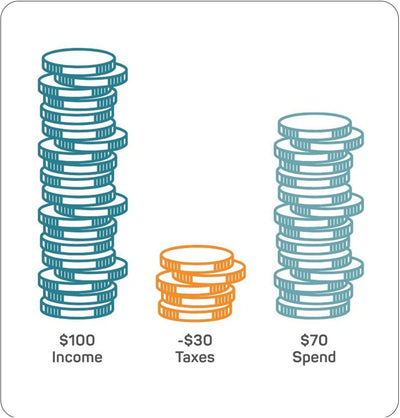

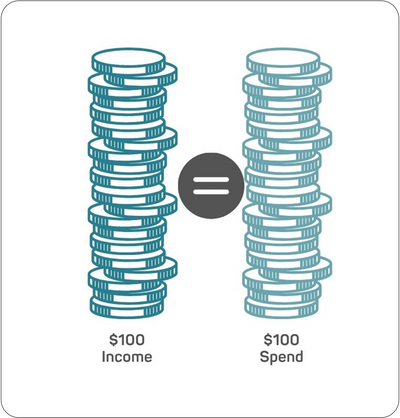

HSA and FSA accounts were created to help people cover qualified health expenses with pre-tax dollars. Because these funds aren’t taxed, you get more purchasing power and can make meaningful investments in your well-being, like a Smart Bed that supports pain relief and deeper rest.

For 2025:

- HSA: Individuals can contribute up to $4,150; families up to $8,300 (plus $1,000 more if you’re 55+).

- FSA: Individuals can contribute up to $3,200, with up to $500 in employer contributions.

We recommend not using your HSA/FSA card directly at checkout. Instead, pay with your regular credit or debit card, then submit for reimbursement using your Letter of Medical Necessity and receipt. This is the most reliable method for approval.

Most claims are reviewed within a few business days, though timing may vary by your plan administrator. You’ll submit your receipt and the Letter of Medical Necessity provided by TrueMed.

No. If you’ve already received a valid Letter of Medical Necessity for purchasing a smart bed, it typically remains valid for 12 months. You still need to submit a receipt each time you request reimbursement.

A Letter of Medical Necessity (LMN) from TrueMed is a document that substantiates your need for a qualified wellness product, such as an iSense Smart Bed, to prevent or treat a diagnosed health condition. It meets IRS standards and is commonly accepted by HSA/FSA plan administrators.

No. If you’re shopping with iSense, a TrueMed partner, there’s no cost to you.

You can use them year-round. But remember: FSA dollars typically expire at the end of the year. Use them before December 31 so you don’t lose them.

You can still submit for partial reimbursement. For example, if your purchase totals $3,000 and you have $2,000 available, you can reimburse that portion and pay the rest as usual.

Reach out to support@truemed.com for help. They’ll assist you with resubmission or issue a new LMN that fits your plan’s requirements.

The link will be included in your order confirmation email, as long as your order includes an eligible bed. You can also access it through your iSense account under your order details.

Invest in Rest. Reclaim Your Wellness.

If you’re struggling with back pain, poor sleep, or daily fatigue, your bed could be part

of the problem. And now, your HSA or FSA can be part of the solution.

Questions?

Contact our Comfort Control™ Specialists at 1-866-910-8605. We’re here to help.

*On average, 30% of gross income is paid to state and federal tax. Individual tax rates vary.