Financing Options

Your Best Sleep, On Your Terms.

Flexible financing options.

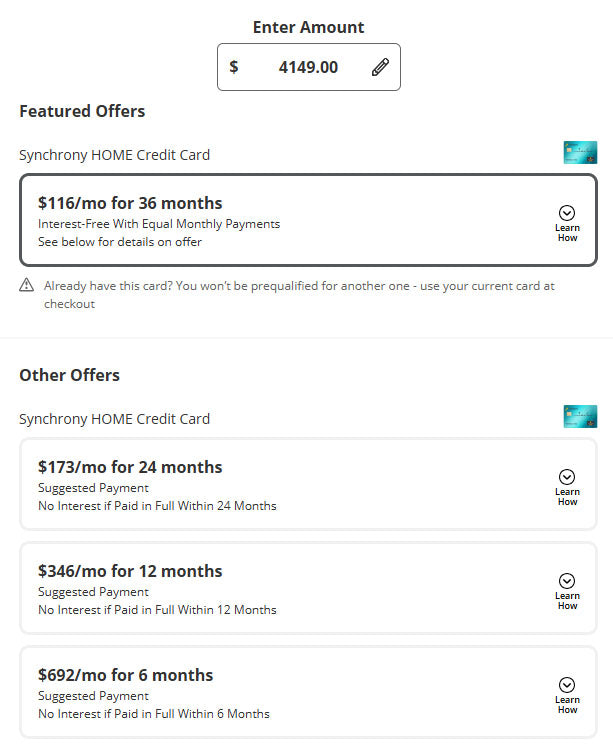

Take advantage of promotional financing plans, including special interest offers when paid in full within the promotional period.

Simple monthly payments.

Spread your purchase over manageable monthly payments designed to fit your budget.

Trusted retail partner.

Synchrony is a widely used financing provider, trusted by millions of customers across major retail brands.

Transparent terms.

Clear financing details are provided upfront so you know exactly what to expect before you commit.

Enjoy better sleep now.

No need to wait. Get the mattress you want today and pay over time with a financing solution that works for you.

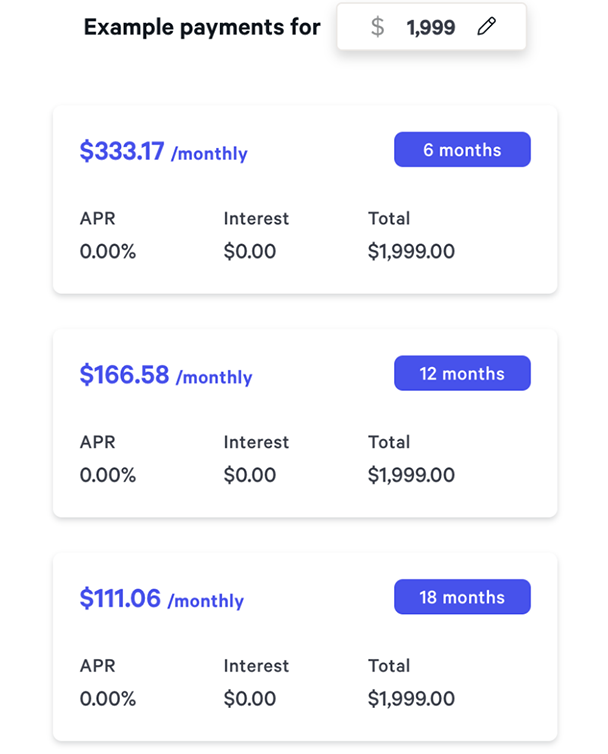

No fees, ever.

No set-up fees, no account fees—not even late fees.Interest is dependent upon purchase.

Pay at your own pace.

You choose your preferred payment schedule from a list of options.

Fully transparent.

The amount you see upfront is the total amount you will pay. There are no hidden costs or additional fees.

Enjoy sleep sooner.

No need to wait. You can purchase a mattress today and make payments that fit your lifestyle.

Financing FAQs

Checking eligibility will not impact your credit. If you decide to pay with installments through Affirm, your payment plan and repayment activity may be reported to credit bureaus.

You can find more information in Affirm’s Help Center.

Affirm offers payment plans with 0–36% APR simple interest, depending on the size of the purchase and your eligibility.

- You will never owe more interest than what you agree to at checkout

- No late fees

- No hidden fees

- No account setup fees

All costs are shown up front before you confirm your loan.

Example: A $700 purchase may cost $63.18/month over 12 months at 15% APR.

Prequalifying means you receive an estimate of the maximum amount you may be eligible to borrow, based on basic information you provide.You are not required to use the full amount and you don’t owe anything unless you complete a purchase.

Only Affirm can provide details on why a loan was not approved. You can contact Affirm directly through their Help Center for more information.

Affirm may ask for:

- Full name

- Date of birth

- Last four digits of your Social Security number

- Mobile phone number

This information is used to perform a soft credit check to verify your identity and make an instant decision.

You can make payments through:

- The Affirm website

- The Affirm mobile app

- Automatic payments

- One-time payments

- Check (by mail)

Payments are flexible, and you can often pay early without penalty.

Applying for financing through Synchronymay involve a credit review. If approved and you open a Synchrony account, this can result in a hard credit inquiry, which may affect your credit score.

Account activity, including payments, may be reported to credit bureaus.

Synchrony offers promotional financing options, which may include:

- No Interest If Paid in Full promotions

- Fixed-term installment plans

For deferred-interest promotions, interest is waived if the balance is paid in full by the end of the promotional period. If not paid in full, interest may be added from the purchase date.

APR and fees vary by plan and are clearly disclosed before you complete your application.

Applying for Synchrony financing means you are applying for a revolving credit account or installment financing, subject to credit approval.

You are not obligated to complete a purchase unless you are approved and choose to proceed.

Synchrony typically requires:

- Full name

- Date of birth

- Social Security number

- Current address

- Income or employment information

This information is used to verify your identity and determine eligibility.

Payments can be made through:

- Synchrony’s online account portal

- The Synchrony mobile app

- Automatic payments (AutoPay)

- Phone payments

- Mail (check)

All questions regarding approval, billing, promotional terms, or account management should be directed to Synchrony using the contact information provided on your statement or during checkout.

Free, no-contact delivery

180-Night Comfort Guarantee

Minimum of 45 Nights